GEICO is the second largest auto insurance provider in the United States. It is second to State Farm. The insurance provider offers coverage to more than 24 million motor vehicles.

Policies featured through GEICO include auto insurance, property insurance, business insurance, and other types of insurance.

Is there a GEICO military discount?

Absolutely! GEICO can get you up to 15% off your total insurance premium. The insurer also presents special rates for military related organizations.

Continue reading the full article to learn all the ways you can save through GEICO and how to get special military rates.

Related Article – Military Discounts: 100+ For Active-Duty + Veterans

Jump To A Section

GEICO Military Center

Types of GEICO Insurance

3 Ways to Get a Quote

Careers for Military at GEICO

Frequently Asked Questions

Conclusion

GEICO Military Discount – Ways to Save on Insurance Premiums

GEICO has special military discounts for service members. You can save up to 15% off your total insurance premium if you are active duty, retired military, or a member of the National Guard or Reserves.

Click Here to visit the Geico military discounts page directly to learn more.

Additionally, GEICO features Emergency Deployment Discounts (up to 25% off) as well as insurance discounts to members of military related organizations. A few examples include:

- Association of United States Army (AUSA)

- Fleet Reserve Association (FRA)

- Armed Forces Benefit Association (AFBA)

- Navy League of the United States (NLUS)

- Navy Federal Credit Union (NFCU)

- American Society of Military Comptrollers (ASMC)

Lastly, GEICO can also pause or reduce the insurance coverage on vehicle(s) stored on a military base while you are deployed.

GEICO mentions that some discounts, coverage, payment plans, and features are not available in all states. Therefore, the GEICO military discount can vary based on your location.

Related Article – Autozone Military Discount: An “Unofficial” Veterans Discount

GEICO Military Center – How to Save on Insurance

GEICO mentions through their website that they have been a proud supporter of the U.S. Military since it opened its doors in 1936. The insurer has provided many men and women of the U.S. Armed Forces with coverage.

As a result, the company created the GEICO Military Center to deal directly with service members.

Click Here to visit the official Geico military center webpage.

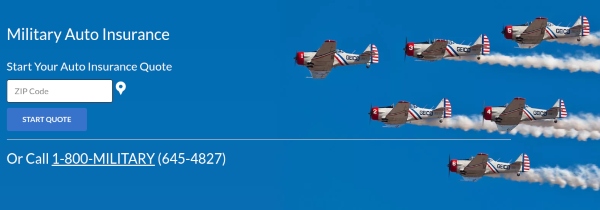

The GEICO Military Center is available at 1-800-MILITARY (800-645-4827). The GEICO Military Center presents customer service 24 hours of the day, 7 days a week!

What is incredible about the GEICO Military Center is the entire customer service staff is made up of veterans. So when you contact someone at the military center you will get an individual on the other end that knows what it is like to serve in the U.S. Military.

GEICO promotes the special service as a way to get veterans connected with active-duty or fellow retirees “who understand the unique circumstances of our servicemen and women.”

Services Offered at GEICO Military Center

The GEICO Military Center provides several key features through its services. Some of the highlights include:

- Custom military insurance ID card from GEICO.

- Military Pay Plan for fast and convenient payments.

- Worldwide coverage no matter where you are stationed.

- Giving back to the U.S. Military through awards and community programs.

For a complete list of services offered through the GEICO Military Center we recommend visiting the official web page here.

Related Article – Toyota Military Discount

GEICO Support Through Deployment

GEICO has proudly served the U.S. Armed Forces for over 75 years. Consequently, the insurer understand the stress and challenges of deployment. It is why GEICO established standards to work with service members pre-deployment, during deployment, and post-deployment.

GEICO even provides a Pre-Deployment checklist to make sure you got all your bases covered before leaving your family.

Click Here to view the predeployment checklist.

GEICO also gets you connected to your new command and base to make sure the transition is as effortless as possible.

During deployment GEICO has multiple services for military personnel:

- Communication: GEICO presents various communication methods including Skype, Google+ Hangouts, and Facebook Chat for staying connected not only to family, but a rep at GEICO if you have any questions/issues with your insurance coverage.

- Emergencies: Red Cross maintains communications with GEICO to inform you of any family emergencies back home. The communication is swift and prompt, and can immediately notify you of any serious illness or death of immediate family members, the birth of a new child or grandchild, or family emergency. The secured phone line 877-272-7337 is provided by families to send urgent messages to service members.

- Support Services & Groups: GEICO wants to help you find the right support group or services for personal issues you may be experiencing. Please do not hesitate to reach out for help!

- Financial & Legal: GEICO wants to make sure you understand your rights under the Service members Civil Relief Act.

Additionally, upon your return from deployment, GEICO can help you transition back to civilian life. The company can assist you with home services, insurance, financial matters, legal matters, and support services provided outside a command center or base.

Related Article – Enterprise Military Discount: 5% Off For Active Duty And Retired Veterans

Types of GEICO Insurance

Do you currently have another insurance provider for home, auto, or property insurance?

Perhaps you should consider switching to GEICO. The company is the second largest insurance provider in the United States for a reason. It is difficult to beat their rates on multiple types of insurance, including:

- Auto Insurance

- Property Insurance

- Business insurance

GEICO Auto Insurance

GEICO can insure a number of different types of vehicles:

- Automobiles

- Motorcycles

- RVs

- ATVs

- Boats

- Collector Cars

- Rideshare Rides

GEICO Property Insurance

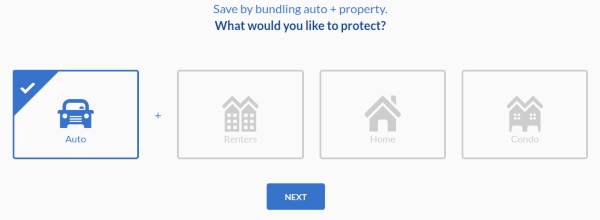

You can bundle auto insurance with one or more of the following types of property insurance:

- Home

- Condo

- Renters

- Mobile Home

- Landlord

- Flood Coverage

GEICO Business Insurance

There are even more ways to package your auto and property insurance into one bundle featured through GEICO:

- Business Owners

- General Liability

- Professional Liability

- Workers Compensation

- Medical Malpractice

- Wellness & Fitness

- Commercial Auto

- Rideshare

GEICO will provide up to 15% off auto, property, and business insurance. When you package one or more types of insurance together through GEICO you could save even more money!

Related Article: 10 Car Insurance Companies Offering Military Discounts (and 8 that don’t)

3 Ways to Get a Quote from GEICO

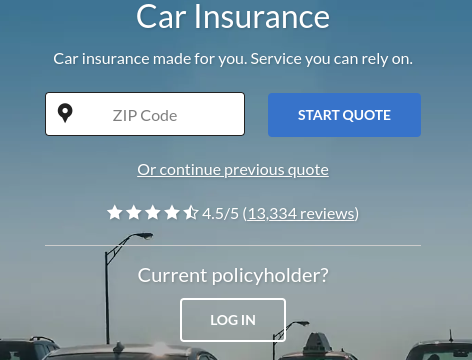

The first method is to get an online quote from GEICO:

- Step 1: Click Here to get a quote online for car insurance. GEICO begins by asking you to enter a ZIP code.

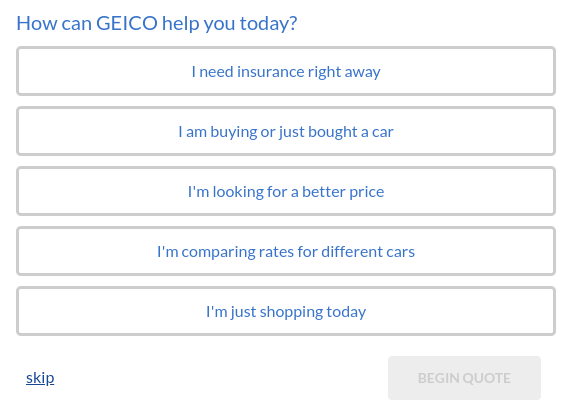

- Step 2: Provide the reason and time frame you are expecting new insurance coverage.

- Step 3: Notify GEICO about the type(s) of insurance coverage you want through them.

Related Article: Bass Pro Shop Military Discount

- Step 4: Continue to fill out personal information. GEICO will need your name, date of birth, and address. GEICO will also request information about the make and model of your car in order to get an accurate auto insurance quote. There are separate questions for those seeking property or business insurance.

Secondly, you can call GEICO through its exclusive hotline for service members: 1-800-MILITARY (800-645-4827).

Finally, the last option is to visit a local GEICO Field Representative in-person. You can find a list of local GEICO agents by clicking here!

Related Article – Hyundai Military Discount

Careers for Military at GEICO

In addition to offering special military rates and services during deployment, GEICO also supports the troops by hiring retired military personnel and reservists.

GEICO provides a variety of career opportunities within their network of major and local office locations.

Are you interested in a job opportunity with GEICO? You can search for available jobs and get started on an application today.

GEICO also provides a Military Skills Translator through the Employment Center. The translator can utilize the branch of service and your military job title to help you locate relevant jobs in the “real world.”

FAQ – GEICO Military Discount

GEICO presents a phenomenal FAQ page for military personnel to reference (Click Here to view it).

Here are some of the most frequently asked questions regarding the GEICO military discount:

Related Article – GM Military Discount: Save $1,000’s On Chevy, GMC, Cadillac, and Buick

I already have insurance. Why should I switch to GEICO?

GEICO is known for having some of the lowest auto insurance rates on the market. The only comparable budget-friendly alternative is Progressive auto insurance.

We really like GEICO because the rates are very affordable on car, truck, motorcycle, RV, ATV, and boat insurance. Additionally, GEICO has a really good track record with its customer service.

If you get annoyed by constantly getting diverted to outsourced customer service in foreign countries, you will appreciate that GEICO handles all of its customer service within the United States.

Lastly, GEICO is known for paying out claims. The company cites that they have $32 billion in assets through Berkshire Hathaway Inc. You can depend on not having to go through a lot of hassle to see money back from a claim.

Can I save more money by bundling insurance through GEICO?

Absolutely. Like most things in life it benefits you to bundle multiple services through the same company. GEICO has several different types of insurance based through the three primary categories of Auto Insurance, Property Insurance, and Business Insurance.

The up to 15% off your total premium for military members can get enhanced when you experience even more savings by bundling two or more insurance packages through GEICO.

It is possible to have your vehicles, home, and business assets protected all under one of the most reliable and well received insurance providers in the nation.

Related Article – Save Up to $500 on a New Ford Truck or Car

How do I get up to 15% off my insurance premium?

The GEICO military discount specifies that you have three options for earning up to 15% off your total premium:

- You can get a quote online at Geico.com. Then speak to a rep over the phone or via the online chat to request a military discount.

- Call 800-MILITARY (645-4827). We have discovered this is the quickest and easiest way to get the GEICO military discount.

- Visit a local GEICO agency in-person. You can find a list of all the available GEICO locations in North America by clicking here.

How does the GEICO military discount compare to the one offered by State Farm?

State Farm is the biggest competitor to GEICO based on auto insurance coverage. State Farm has several discounts, including those that reward safe drivers, active duty military, students, and families with multiple household vehicles.

We recommend calling 800-STATE-FARM (800-782-8332) as the insurer does not specify how much you could save on auto insurance only that they offer a military discount for active duty personnel.

State Farm also has a wide range of types of insurance coverage including auto, property, life, health, disability, and liability insurance. They are a worthy competitor to GEICO and you really can’t go wrong with either provider.

How does the GEICO military discount compare to USAA?

USAA is a popular way that military personnel invest in auto insurance, banking, and home and renters insurance. The membership is exclusive to active duty military, National Guard, and Reserves. It is also available to veterans, Cadets and Midshipmen at U.S. service academies, and eligible family members.

We noticed that in most states the GEICO military insurance premiums were very comparable to rates offered through USAA. GEICO has a reputation for providing better deals for veterans and those that are not deployed compared to USAA.

Meanwhile, if you are active duty you may receive a better deal through USAA while deployed. It is a good idea to compare and contrast the two quotes. Once again it does depend on location and other factors.

Related Article – Advance Auto Parts Military Discount: 10% Off Your Order

Conclusion

GEICO provides active duty military personnel and retirees with up to 15% off their total insurance premium. There are a number of other services they include for soldiers pre-deployment, during deployment, and post-deployment at no extra charge!

In order to take advantage of auto, property, and/or business insurance through GEICO call 800-MILITARY (645-4827). You can save even more when you bundle multiple insurance coverages through GEICO.

- Replacing Dog Tags: 6 Things You Need to Know - June 28, 2024

- Navy OAR Test Study Guide - June 24, 2024

- 10 Best Sniper Movies of all Time - June 20, 2024

Originally posted on August 31, 2019 @ 6:44 pm

Affiliate Disclosure: This post may contain affiliate links. If you click and purchase, I may receive a small commission at no extra cost to you. I only recommend products I have personally vetted. Learn more.